Renters Insurance in and around North Aurora

Looking for renters insurance in North Aurora?

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- North Aurora

- Aurora

- Batavia

- Geneva

- St Charles

- Elburn

- Naperville

- DeKalb

- Sugar Grove

- Maple Park

- West Chicago

Home Sweet Home Starts With State Farm

Even when you rent a place to live you still have plenty of responsibility. You want to make sure what you own is protected in the event of some unexpected damage or trouble. And you also need liability protection for friends or visitors who might become injured on your property. State Farm Agent Danielle Rouille is ready to help you prepare for potential mishaps with high-quality coverage for your renters insurance needs. Such thoughtful service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Danielle Rouille can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Looking for renters insurance in North Aurora?

Rent wisely with insurance from State Farm

Agent Danielle Rouille, At Your Service

The unexpected happens. Unfortunately, the possessions in your rented townhome, such as a tool set, a set of favorite books and a TV, aren't immune to smoke damage or vandalism. Your good neighbor, agent Danielle Rouille, has the knowledge needed to help you choose the right policy and find the right insurance options to protect your belongings from the unexpected.

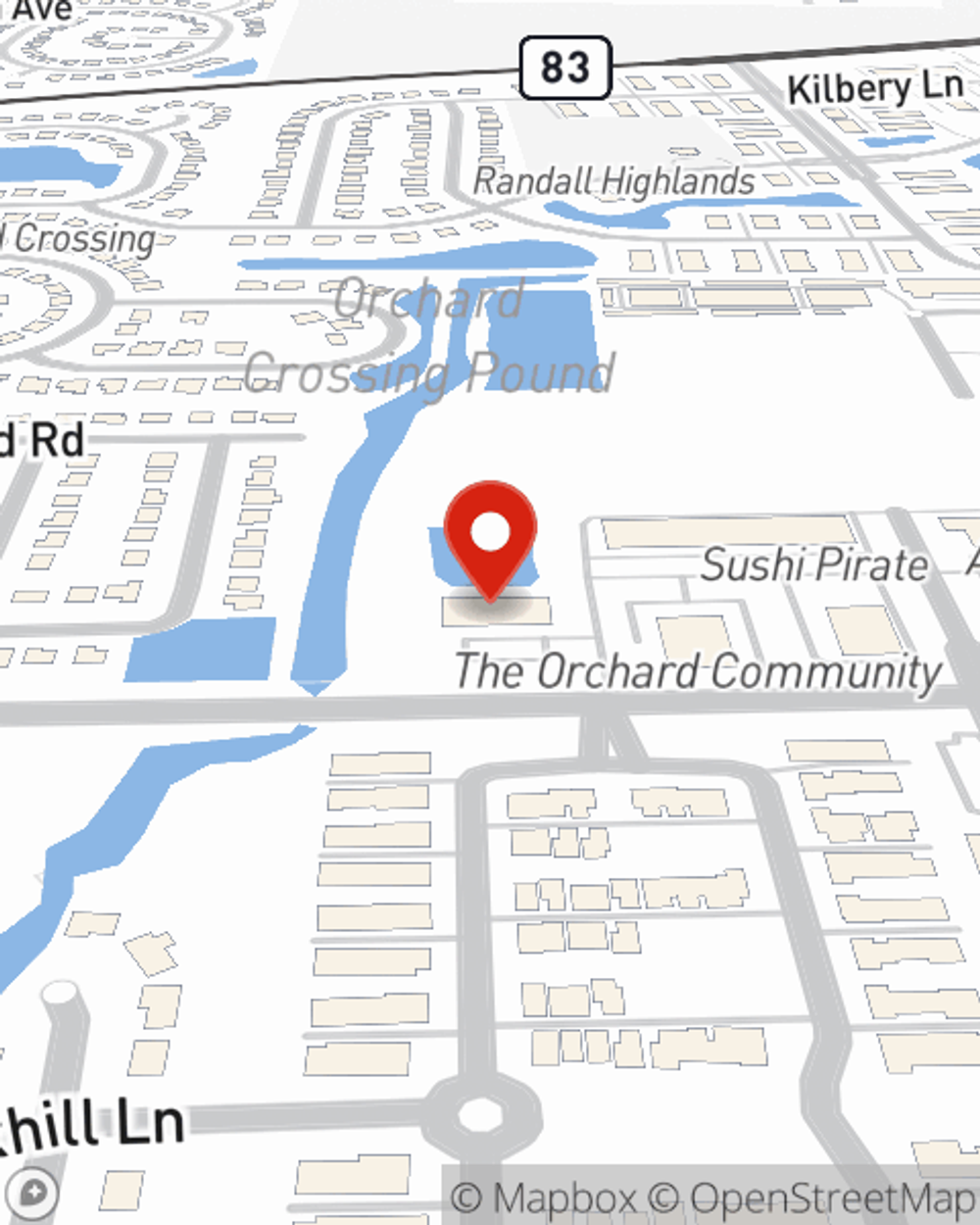

Get in touch with State Farm Agent Danielle Rouille today to check out how a State Farm policy can protect your possessions here in North Aurora, IL.

Have More Questions About Renters Insurance?

Call Danielle at (630) 859-2280 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Danielle Rouille

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.